The Sakura season, where cherry blossoms across Japan are in full bloom, is one of the most anticipated and celebrated events in the country. Millions flock to the peninsula every year to witness the Sakura flowers every year, a time for joy, festivity, and renewal.

As we have seen in the previous stories in this series, the Sakura season is also a major driver of economic activity, as travellers from around the world visit various prefectures to soak in the sight of the flowers and immerse themselves in Japan’s rich culture.

In this final story of the series, Visa uncovers how the use of contactless payment methods, such as credit cards and digital wallets accelerated travel spending during the Sakura season in Japan.

Contactless payments make travel simpler and safer

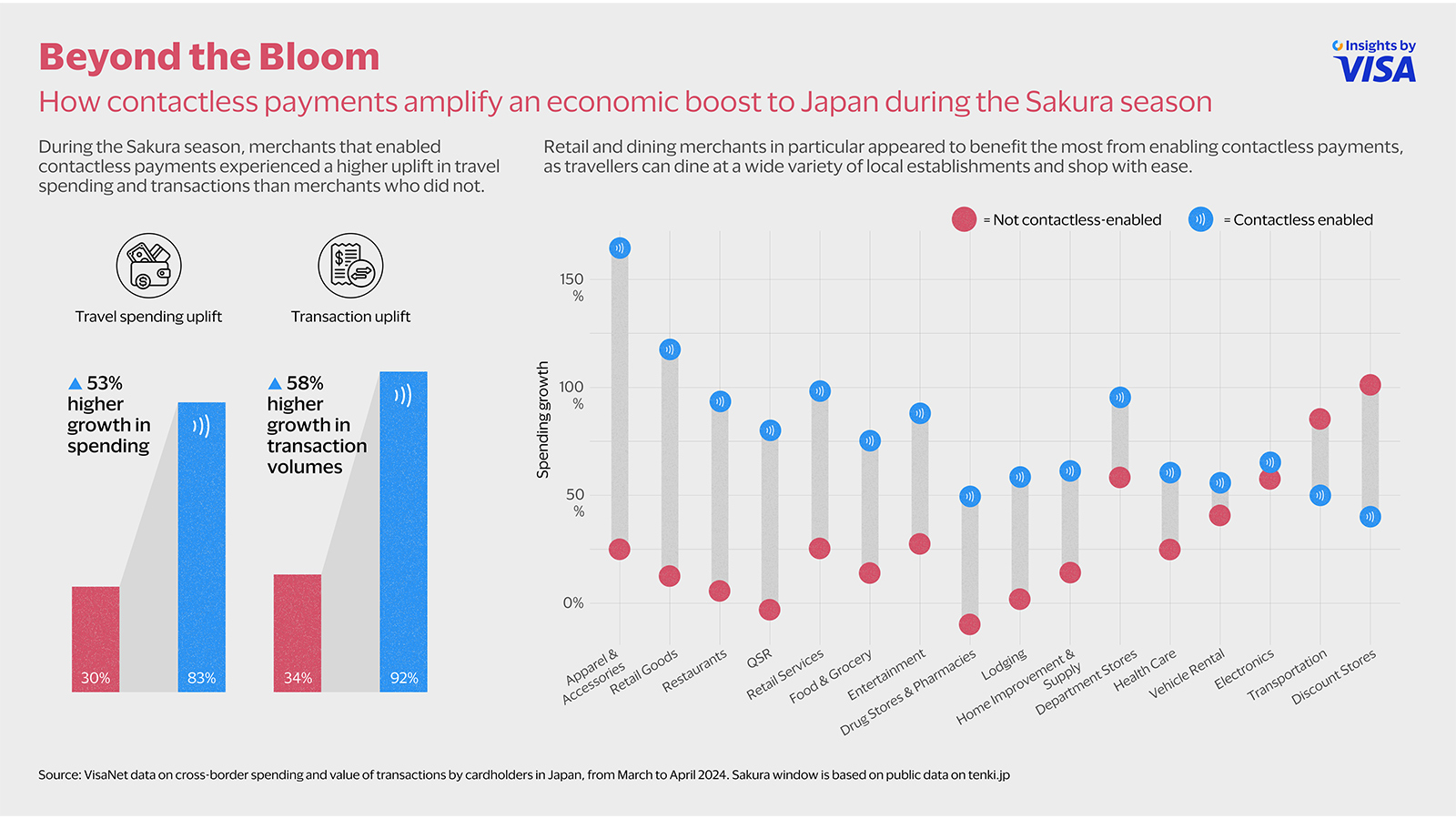

Visa’s analysis of contactless spending in 17 prefectures¹ during the Sakura season found that, compared to merchants that do not enable contactless payments, merchants that did so experienced a 53 percent higher uplift in travel spending and a 58 percent higher uplift in transactions compared to the Sakura season in 2023². This remained consistent across the prefectures analysed by Visa, indicating a growth in contactless payment usage by travellers to Japan.

The same trend was also seen for restaurants, as travellers can dine at a wide variety of local establishments and pay seamlessly for their meals with contactless cards. Japanese drug stores, popular among those seeking Japanese skincare and cosmetics, also generated a much higher uplift in travel spending from contactless-enabled cards. These reflect a widening use of contactless cards for quintessential travel spending, representing a huge opportunity for merchants in these segments.

A major factor for the use of contactless payments is convenience. They allow customers to simply tap their cards or devices on a terminal, making purchases faster and smoother while reducing the waiting time and hassle of handling cash, especially for travellers who are already used to making contactless payments back home. Contactless payments also offer security, as they are protected by encryption and authentication features that prevent fraud and theft.

For merchants, contactless payments are an opportunity to turn the influx of travellers to Japan into additional revenues. Increased merchant education on contactless payments by financial institutions could also accelerate adoption by inculcating greater confidence and familiarity with contactless cards.

Contactless payments make Japan more accessible

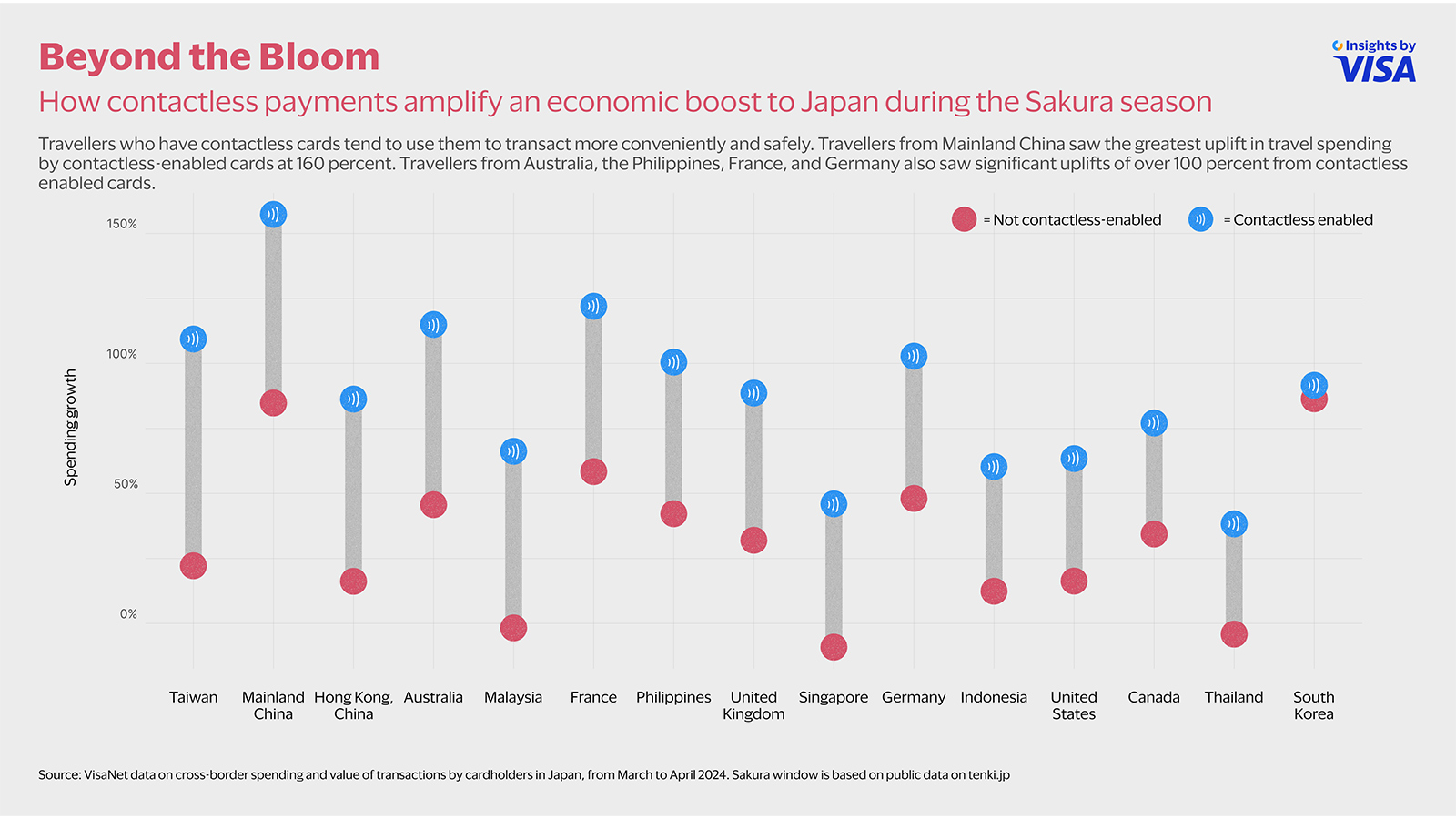

Analysis of contactless payment spending by travellers from different countries also found that contactless-enabled cards drove a marked higher uplift in spending, compared to cards that do not enable contactless spend. This suggests that travellers who use contactless cards tend to use them to transact more conveniently and safely.

Across the countries of origin analysed by Visa, travellers from Mainland China saw the greatest uplift in travel spending by contactless-enabled cards at 160 percent. Travellers from Australia, the Philippines, France, and Germany also saw significant uplifts of over 100 percent from contactless enabled cards⁴. Travellers from countries with better contactless maturity⁵, such as the United States, Thailand, Canada, and France, among others, actively used contactless payments from the first day of their trips, fuelling this trend.

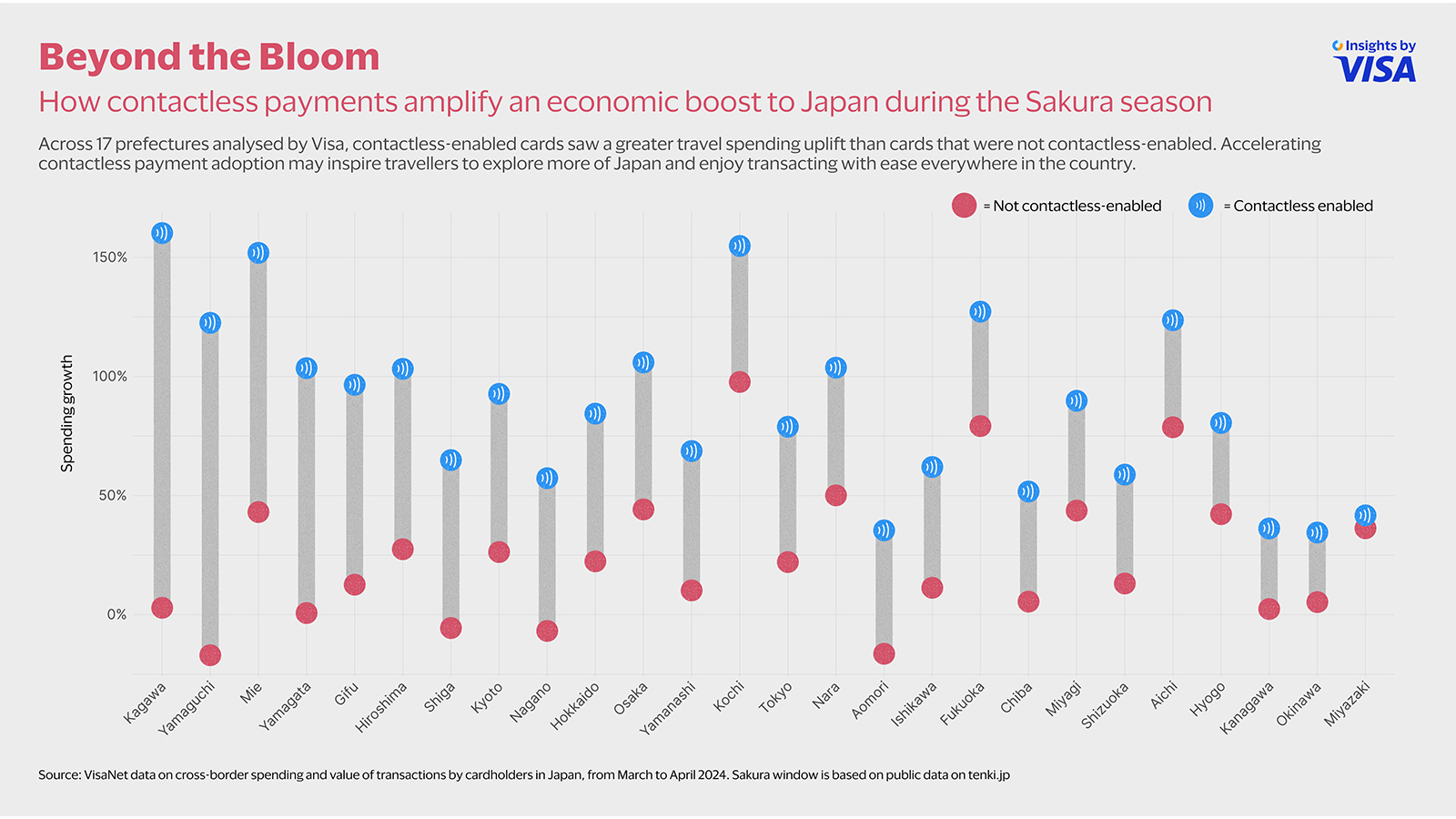

Visa also found that across the prefectures, contactless-enabled cards saw a greater travel spending uplift than cards that were not contactless-enabled.

Reflecting the overall trend, this suggests that accelerating contactless payment adoption can inspire travellers to explore more of Japan and enjoy transacting with ease everywhere in the country. For example, travellers can enjoy the same convenience and security for public transport and when they shop in city centres, while contactless payments can make cultural experiences more frictionless as travellers can handle less cash and immerse in local sights more fully.

Read more travel insights on the Sakura season in Japan here

¹ The 17 prefectures are Mie, Aichi, Kyoto, Aomori, Miyagi, Fukuoka, Shizuoka, Gifu, Tokyo, Nara, Osaka, Yamanashi, Ishikawa, Hyogo, Kagoshima, Hiroshima, Yamaguchi

² Source: VisaNet data on cross-border spending and value of transactions paid by Visa cardholders in Japan, including contactless-enabled Visa cards and cards that do not enable contactless transactions. The term "uplift” refers to comparison of cross-border payment volumes by Visa cardholders in these two categories during the 2024 Sakura window, contrasted against the 2023 Sakura window.

³ Source: VisaNet data on cross-border spending and value of transactions paid by Visa cardholders in Japan, including contactless-enabled Visa cards and cards that do not enable contactless transactions. The term "uplift” refers to comparison of cross-border payment volumes by Visa cardholders in these two categories during the 2024 Sakura window, contrasted against the 2023 Sakura window.

⁴ Source: VisaNet data on cross-border spending and value of transactions paid by Visa cardholders in Japan, including contactless-enabled Visa cards and cards that do not enable contactless transactions. The term "uplift” refers to comparison of cross-border payment volumes by Visa cardholders in these two categories during the 2024 Sakura window, contrasted against the 2023 Sakura window.

⁵ Markets are identified as medium contactless maturity if they fall within the 33rd to 66th percentile range in terms of the share of contactless transaction.