In Southeast Asia, embedded finance solutions are changing the way consumers engage with financial products. As financial products and services become increasingly integrated into popular retail platforms and apps, consumers can now access a wide range of solutions, from personal insurance to installment plans, right at the point of purchase.

The growing diversity of embedded finance in Southeast Asia reflects its accelerating growth in Asia Pacific, with the sector expected to unlock more than US$242 billion in opportunity for the region’s financial providers by 2025. This is matched by growing consumer appetite and appreciation for the various applications of embedded finance, uncovered in Visa’s latest Consumer Payment Attitudes Study.

Speed, convenience, security are driving adoption of embedded payments

Embedded payments, or the integration of digital payment solutions into commercial platforms or apps, are not new but are creating new conveniences for consumers in Asia Pacific.

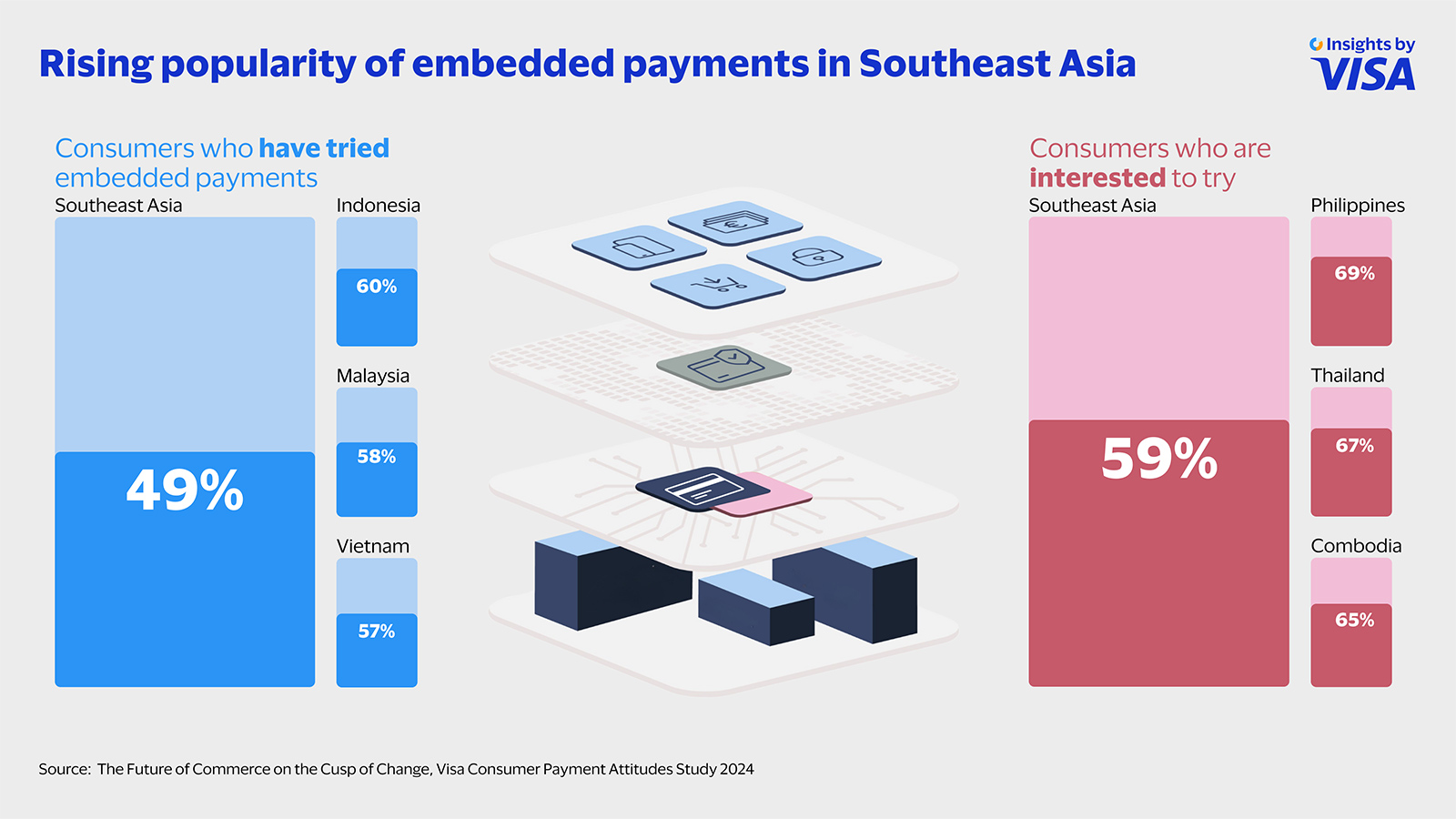

Indeed, the Consumer Payment Attitudes Study showed that convenience (56%) and speed (46%) are fueling interest in embedded payments. Nearly a third (30%) of respondents view them as a more secure mode of payment since users don’t have to be redirected to an external website or gateway. In terms of usage, nearly half (49%) have tried using embedded payments and 59% of non-users said they are interested in trying it in the future.

Embedded payments are most commonly seen in social media, non-financial apps, and digital channels including websites and apps. In fact, super apps and e-commerce platforms are driving adoption as they seek to attract new customers with more diversified offerings. Embedded payments eliminate the need for customers leave a shopping environment to pay for their purchases – instead, they are offered access to an array of digital payment options, such as an integrated digital wallet, at checkout. This enables a frictionless experience, while making customers feel more secure as opposed to being redirected to an external site for payment.

For merchants, embedded payments can create satisfied and loyal customers in the long run. The speed and security of payments also accelerate trust in digital payments, thus speeding up the adoption of digital payments in Asia Pacific.

Consumers appreciate the flexibility of embedded lending

While embedded payments are the most common use of embedded finance, embedded lending is also growing fast in Southeast Asia – providing instant access to loans and credit through online platforms and apps consumers are using today.

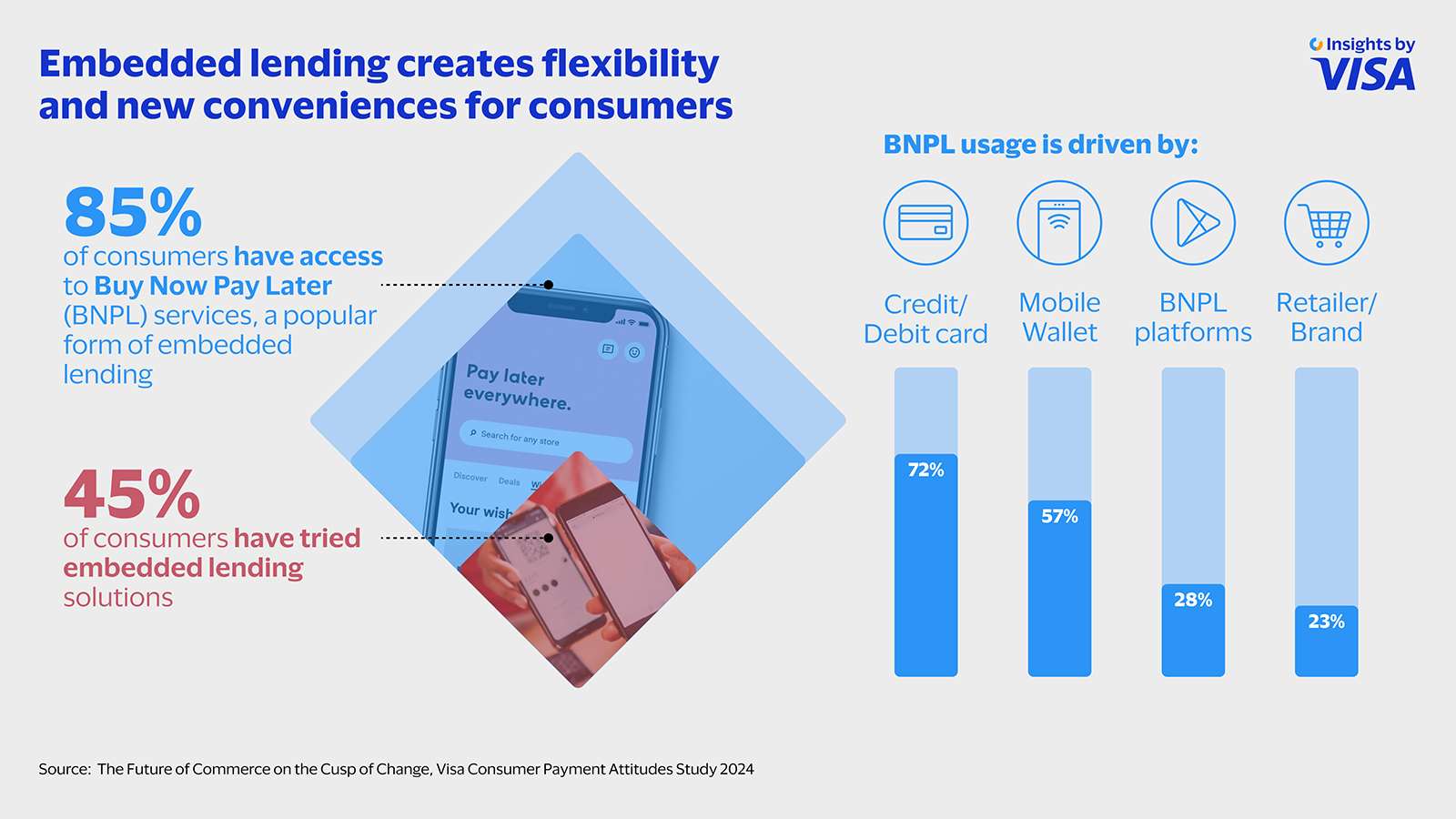

Buy Now, Pay Later (BNPL) – an option that is often offered during online checkout to allow split payments over time – is a highly popular form of embedded lending. 85% of respondents in the Consumer Payment Attitudes Study have used it, and half of non-users are interested to try it in the future.

Our survey also showed that digital payments play an important role in driving BNPL usage: more than half (57%) of BNPL usage is primarily through mobile wallet providers, while credit (42%) and debit cards (29%) are also widely used for instalment solutions.

According to the study, embedded lending solutions are attractive because they offer flexible payments (38%) and the convenience of applying for loans or financing on a single platform (36%). Increasingly, merchants are also offering card installment solutions, such as Visa Installment Solutions (VIS) at checkout, giving cardholders the option to break up their card expenses and better manage their budgets, especially for larger purchases like electronics, furniture, or holiday trips.

Personalisation to fuel the growth of embedded insurance

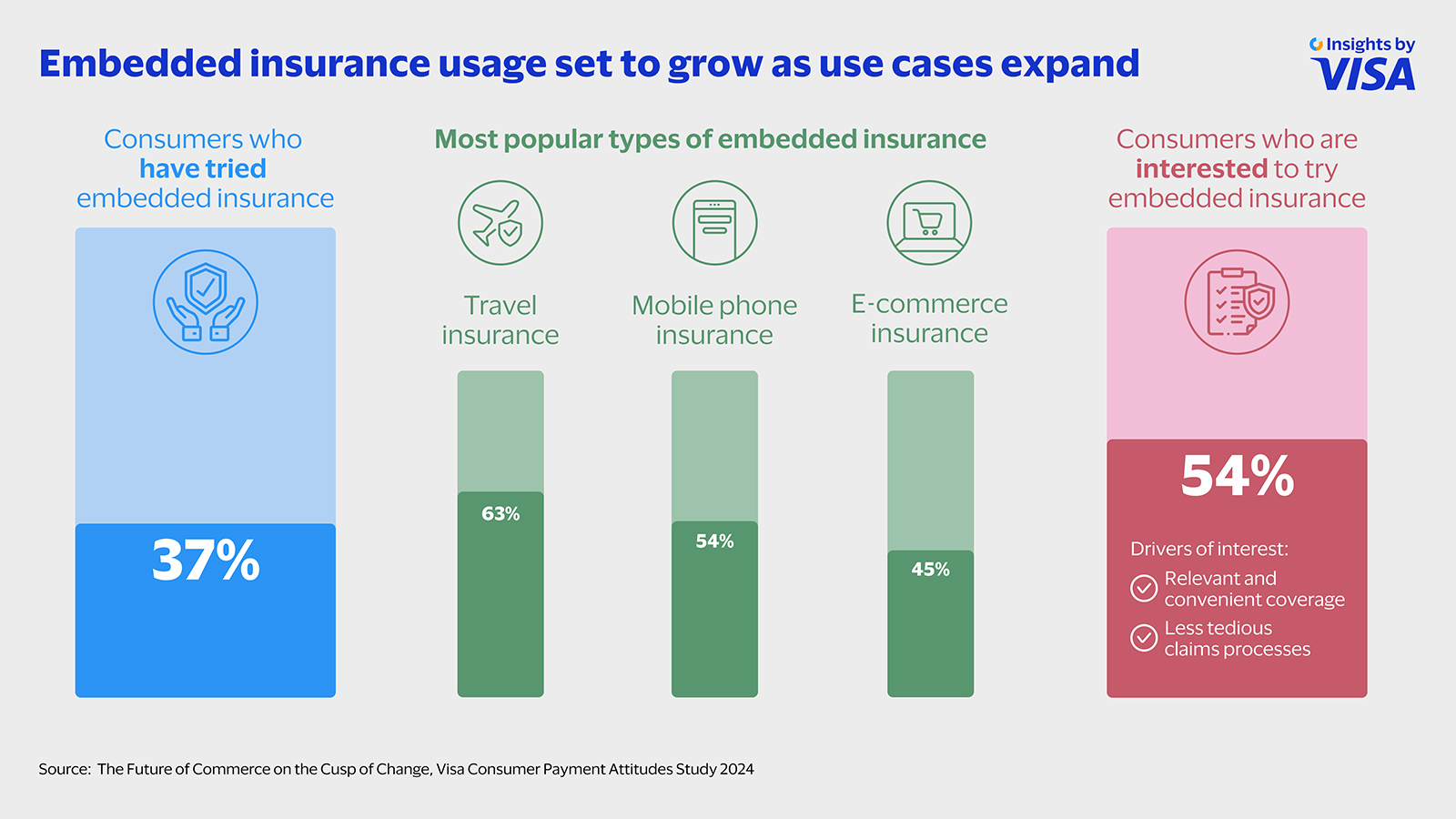

Compared to embedded payments and lending, embedded insurance is less developed in Southeast Asia, with only 37% of consumers in the study saying they have used it before.

Super apps and platforms often cross-sell insurance services with their core offerings, such as insurance for delays and accidents on ride-hailing platforms, damage protection for online shopping purchases, or travel insurance when making bookings on online travel agencies. Indeed, Travel insurance is the most popular type (63%), followed by mobile phone (54%) and e-commerce (45%).

This way, consumers have easy access to the insurance solutions they need at the time that they’re likely to need it. Embedded lending is expected to grow rapidly in the coming years as consumers seek more personalised and timely offerings, with 54% of non-users expressing an interest in trying embedded insurance products in the future.

Embedded payments, lending, and insurance are set to drive the growth of embedded finance in Southeast Asia for the foreseeable future. As more consumers in Asia Pacific go cashless, the Consumer Payment Attitudes Study has shown that cards continue to play a leading role in the way people fund emerging forms of digital payments, such as digital wallets. Cards are also already integrated in the way people pay for embedded finance solutions, such as Visa Installment Solutions at the point of checkout, and paying for embedded insurance services while booking long-awaited holiday trips.

Embedded finance promises easier, frictionless, and more personalised retail and banking experiences in Southeast Asia. Further developments could include cutting-edge risk and authentication solutions, including biometric payments that make checkouts even more frictionless, while tools like generative AI can make embedded finance more tailored to the individual.