Generative AI is set to transform how we live and work, sparking vigorous discussion about its current and future impact on industries and consumers in almost every corner of the world. In Southeast Asia, businesses – from banks to retailers – are already taking action to weave the technology into their products and services.

Consumers are sitting up and taking note. In fact, Visa’s latest Consumer Payment Attitudes Study among more than 6,550 consumers in Southeast Asia found that the large majority of respondents (75%) are aware of generative AI and it is beginning to shape how they spend, shop, and save.

Generative AI set to enable faster, safer banking

Large banks and financial institutions in Southeast Asia have been quick to develop and integrate Gen AI-powered chatbots, among other AI applications, to support customers. As a result, for many in the region, their first encounter with Gen AI may be with a chatbot or live assistant on a website or banking app. Many are responding positively to these applications, with 34% of respondents saying they are interested in AI-led live messaging features from banks, while another 34% are interested in voice chat capabilities.

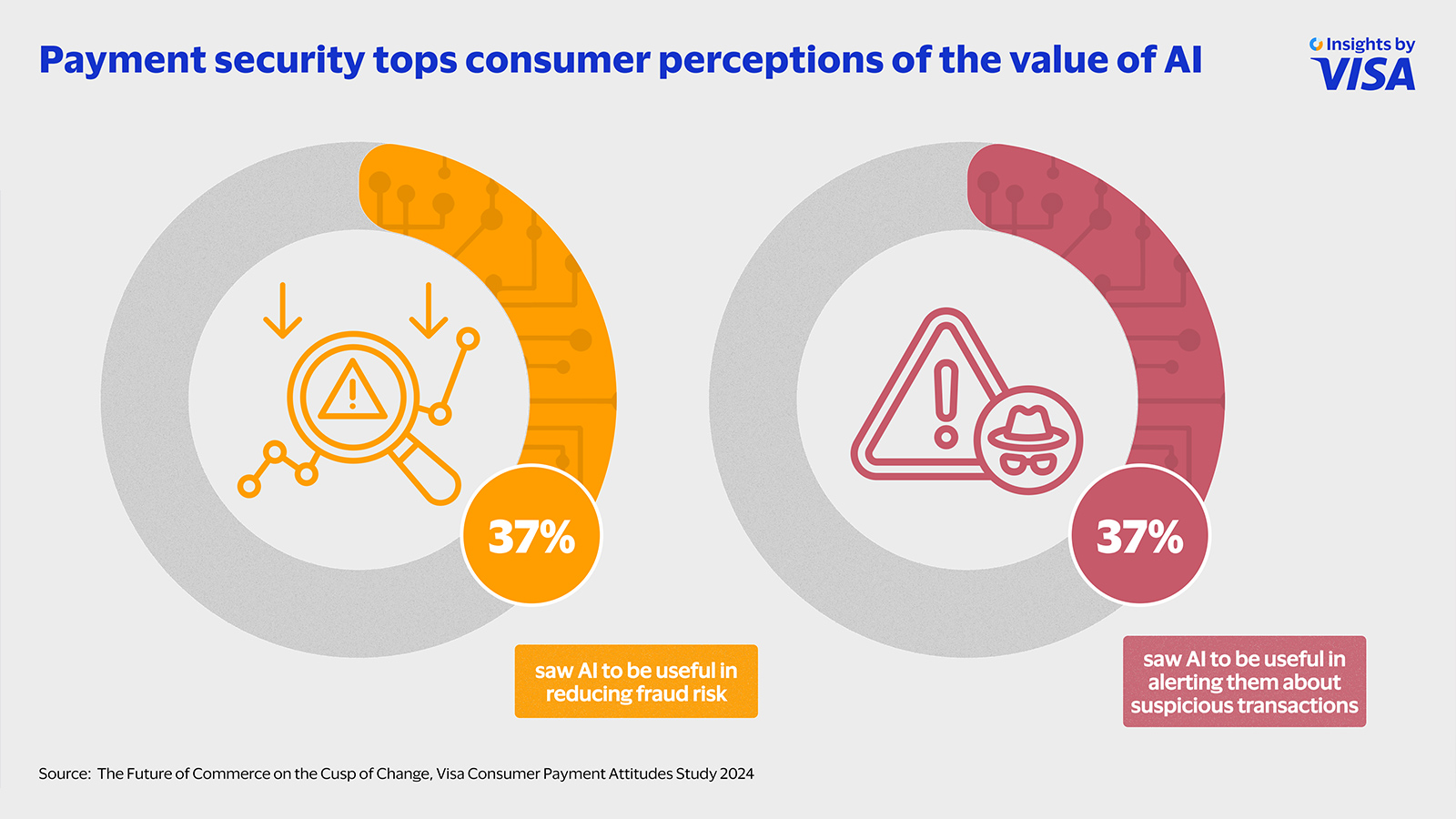

But the technology’s greatest perceived value in banking lies in improving the security of financial transactions. Our survey showed that consumers viewed generative AI as useful in reducing fraud risk (37%). An equal proportion of respondents see the value in using the technology to alert customers about suspicious transactions.

As fraud becomes more sophisticated, banks, particularly in more advanced economies, are embracing AI-powered tools to fight fraud. Singapore’s DBS, the largest lender in Southeast Asia by assets¹, has developed a surveillance system that uses AI and machine learning to screen transactions and flag suspicious activities². Similarly, OCBC’s AI Lab is tackling credit card fraud with an AI-powered system to help identify abnormal payment transactions and analyse merchant information to help determine whether a transaction is risky³. These tools help banks offer better security to their customers while achieving substantial savings for the bank from the reduced number of fraud cases.

Operational efficiency is another area where consumers believe generative AI is of value. AI is helping banks increase productivity by accelerating the automation of routine tasks, such as transaction processing. Indeed, consumers are responding well to such efforts with around one third (34%) saying that the use of Gen AI in banking appeals to them because it saves them time by shortening the processing period of certain transactions.

Another frontier where Gen AI holds promise is in aiding financial decision-making – 34% of consumers surveyed said the technology would be valuable in helping them receive timely financial advice, while 32% are interested in product and service recommendations generated by AI.

Generative AI is still in its nascent stages of development in Southeast Asia, but the future is bright. While only 32% of consumers have used generative AI services in banking, 71% of non-users are interested in trying it out in the future, suggesting not only the potential for rapid adoption of existing solutions, but also a growing appetite for new applications that have not been developed yet.

Creating smarter, more responsive retail experiences

Aside from financial services, Gen AI also has the power to create more bespoke retail experiences by analysing customer data, preferences, and specifications.

Like banks, Southeast Asia’s large online retail platforms have embraced Gen AI-led chatbots to answer shopper queries, offer suggestions, and deliver timely product recommendations in various languages⁴. Indeed, more than a third of respondents in the Consumer Payment Attitudes Study have tried using Gen AI for online shopping, particularly for fashion items, home appliances, personal care, personal electronics, and home furnishings. And almost two in three (64%) respondents in our survey see Gen AI as a useful tool for personal shopping and are interested in trying out the technology in the future as user-friendly consumer-facing tools make the technology more accessible.

As generative AI evolves, new and different use cases are only going to expand beyond the chatbots and personalised recommendations we see today, becoming more integral to the retail experience. McKinsey estimates that generative AI could contribute an additional US$2.6 trillion to $4.4 trillion to the global economy each year⁵.

Quality data will be important in unlocking its full potential and cards have a crucial role to play here, helping merchants deliver better experiences for customers and increase sales. Card payments data, in particular, can offer valuable aggregated information on consumer interests and preferences to Gen AI models. This can in turn help businesses refine their marketing campaigns, design hyper-personalised offers and rewards, and even offer the right embedded finance solutions based on consumers’ credit and banking histories.

3 https://www.ocbc.com/group/careers/blog/detecting-credit-card-fraud.page

⁴ https://news.microsoft.com/en-sg/2023/05/30/lazada-unveils-lazziechat-the-first-ecommerce-ai-chatbot-of-its-kind-in-se-asia/; https://marketech-apac.com/ponds-shopee-skin-analysis-chatbot/; https://retailasia.com/e-commerce/news/zalora-launches-ai-powered-customer-service-chatbot-in-southeast-asia; https://www.grab.com/sg/press/others/grab-and-openai-announce-strategic-collaboration-first-of-its-kind-in-southeast-asia/?utm_source=substack&utm_medium=email