The gig economy is not a passing trend in Asia Pacific. It is a vital force that is reshaping the way people work, earn, and live. As work-from-anywhere and flexible work practices become common, gig work is becoming a popular way to supplement incomes, pursue passions, and contribute to communities. This mirrors the rising importance of platform services to consumer lifestyles and economies. One in five consumers globally are using platform apps, an addition of over 300 million new consumers since 2019, according to research on depersonalised cardholder data by Visa Business and Economic Insights.

According to Visa’s recent Green Shoots Radar survey among over 8,000 respondents in Asia Pacific, the rise of gig and flexible work is creating new payment needs that are not the same as with conventional roles. Gig workers tend to receive compensation more often and in batches, such as digital creators who are hired on contractual bases and paid upon reaching project milestones. Current modes of payments have catching up to do when it comes to helping gig workers be paid with more speed and certainty.

To unlock the full potential of Asia Pacific’s gig economy, governments, policymakers, and financial institutions should strive for quicker, more frictionless, and safer transactions that promote financial security and assurance for this new normal for work.

Gig work is no longer a “side hustle”

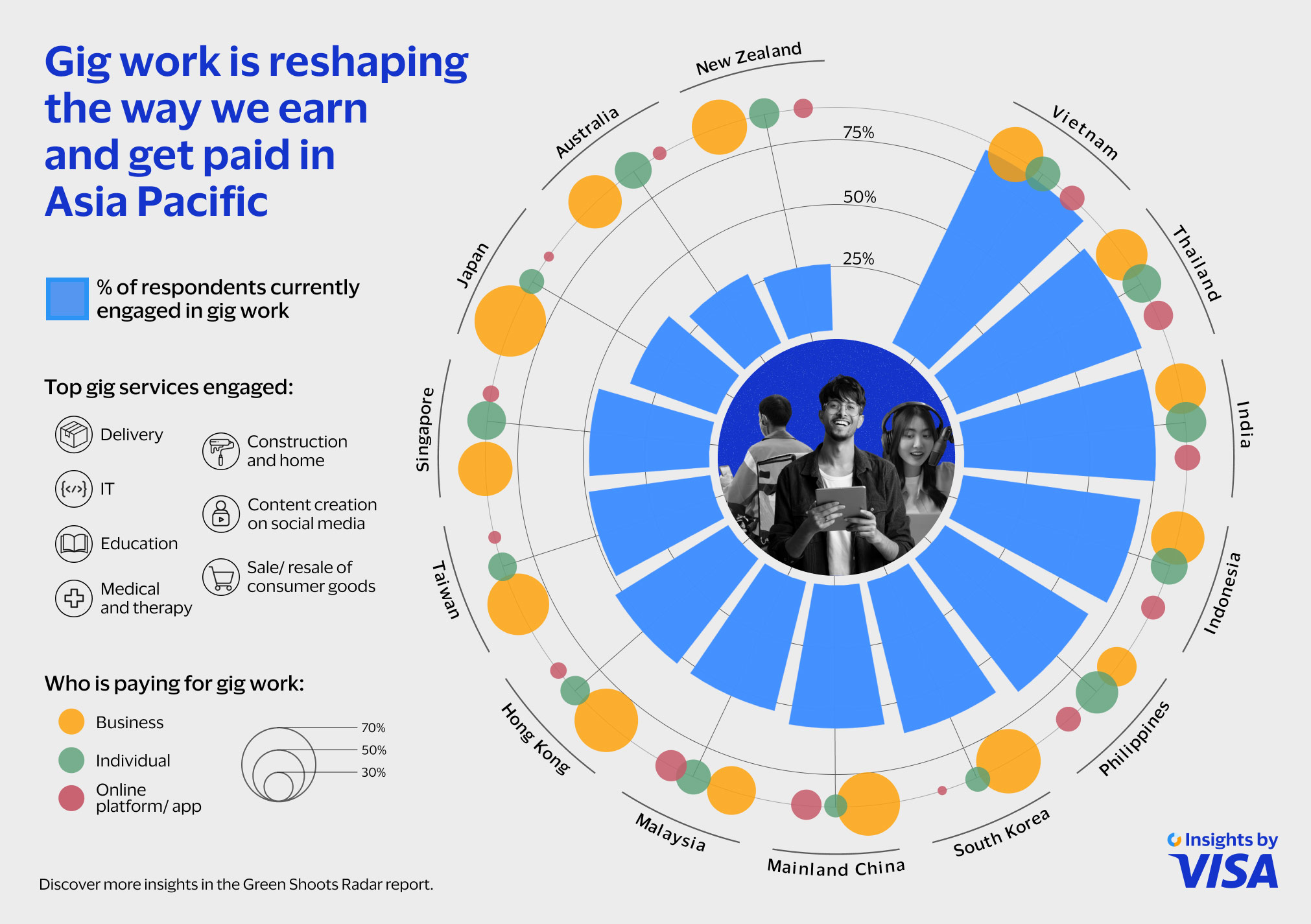

According to Visa’s Green Shoots Radar report, 57% of respondents in Asia Pacific said they participate in gig work – referring to freelance or temporary jobs on full time, part time, or on project bases.

Indeed, gig work is becoming a professional reality in Asia Pacific. For one, gig work is especially frequent among younger segments, with 67% of Gen Z respondents indicating that they participated in some form of gig work. Younger Millennials reported similar figures (67%), followed by Older Millennials (64% ) compared to 55% for Gen X and 32% for Baby Boomers .

For another, gig work is becoming the sole or main source of income in some parts of Asia Pacific. While 55% of respondents in Asia Pacific saw gig work as one source of income, the majority of respondents in Hong Kong (52%), Japan (65%), Korea (66%), India (57%), and Australia (53%) said gig work is their only source of income. This mirrors global Visa research that found two thirds of app economy workers rely on their gig income as a primary source of earnings.

These numbers in the Green Shoots Radar report mirror a growing importance of gig work globally. According to Stylus, 36% of American workers reported engaging in some independent employment in 2022, up from 27% in 2016¹. The World Bank has also estimated that gig work accounts for 12% of the global labour market in 2023.

Who is paying for what work?

As the gig economy grows in Asia Pacific, it appears to be defying conventional notions about the type and nature of gig work performed. Indeed, workers in Asia Pacific may be pursuing a new mode of work beyond salaried employment and monetising their skills in response to needs in their markets.

According to the Green Shoots Radar report, 3 in 5 gig workers surveyed (60%) said they provide professional work paid by companies, followed by online platforms, website, or apps, and finally individuals paying for specific services.

The Green Shoots Radar report revealed five key gig services in Asia Pacific, among others:

- Sale and resale of consumer products; such as clothing, accessories, electronics, and books

- Content creation on social media; such as videos, podcasts, blogs, or live streaming

- Information technology services; such as web development, software engineering

- Education services; such as tutoring, coaching, and online teaching

- Delivery services; such as food, groceries, and parcels

It reflects an increasing diversity in the kinds of gig work done in Asia Pacific, as people and businesses alike realise that more jobs can be done remotely and flexibly. This is especially so for content creation, fuelled by rising demand for digital content on social platforms and in turn, demand for content creators who monetise what they produce and be paid easily through peer-to-peer payments.

However, there was great diversity in the kinds of gig work engaged by respondents in different age groups and markets. For instance, compared to other age segments, Gen Zs in Asia Pacific showed greater incidence of engaging in writing services and art and design services.

Across the markets, respondents in mainland China were also more engaged in content creation than in other markets, while respondents in India were more engaged in IT services and Education services than in other markets.

Making gig payments work

According to the Green Shoots Radar report, most gig workers receive payments at least once a month or more and most frequently through bank transfers . In addition, 40% prefer direct payment transfers to their bank accounts, versus just 24% to mobile wallets and 17% for cash.

These preferences may be motivated by three key factors: Speed, Certainty, and Cost. Because workers receive payments more frequently and potentially from clients both at home and abroad, delays and lack of clarity about payments can derail their work and incomes. Indeed, 31% of Asia Pacific respondents cited time to receive payments as a pain point, while uncertainty about when they will receive payments (21%) and whether payments are correct (14%) were related concerns. 22% cited additional fees, such as transaction and processing fees in certain payment methods as pain points that eat into incomes.

Existing payment and payroll systems in Asia Pacific need to evolve to meet the growing scale of the gig economy. Models such as earned wage access, fuelled by the growth of fintech platforms in Southeast Asia are tackling the issue of speed by helping workers access part of their pay early, despite challenges in fees and funding.

Alternatively, solutions like Visa Direct already facilitate the delivery of funds directly to millions of eligible cards, bank accounts, and digital wallets. With gig workers in the region serving clients beyond local borders, they benefit from the three billion cards, two billion accounts, and 1.5 billion wallets that Visa Direct connects to globally.