BNPL plans are integrated with online shopping

It’s no wonder then that Visa’s latest Green Shoots Radar survey shows a rise in BNPL use across Asia Pacific – particularly among Gen Zs and millennials in Southeast Asia.¹

A key driver for this uptick is the increasing integration of BNPL plans within e-commerce platforms and retailers’ websites. Visa’s survey shows 76% of Asia Pacific respondents used an installment payment when shopping online.

Installment payment plans help merchants grow sales and their customer base. Asia Pacific consumers use them to purchase products under flexible payment terms. These can include discretionary and aspirational products for personal and home use, primarily personal electronics such as mobile phones, household appliances, and personal retail items.

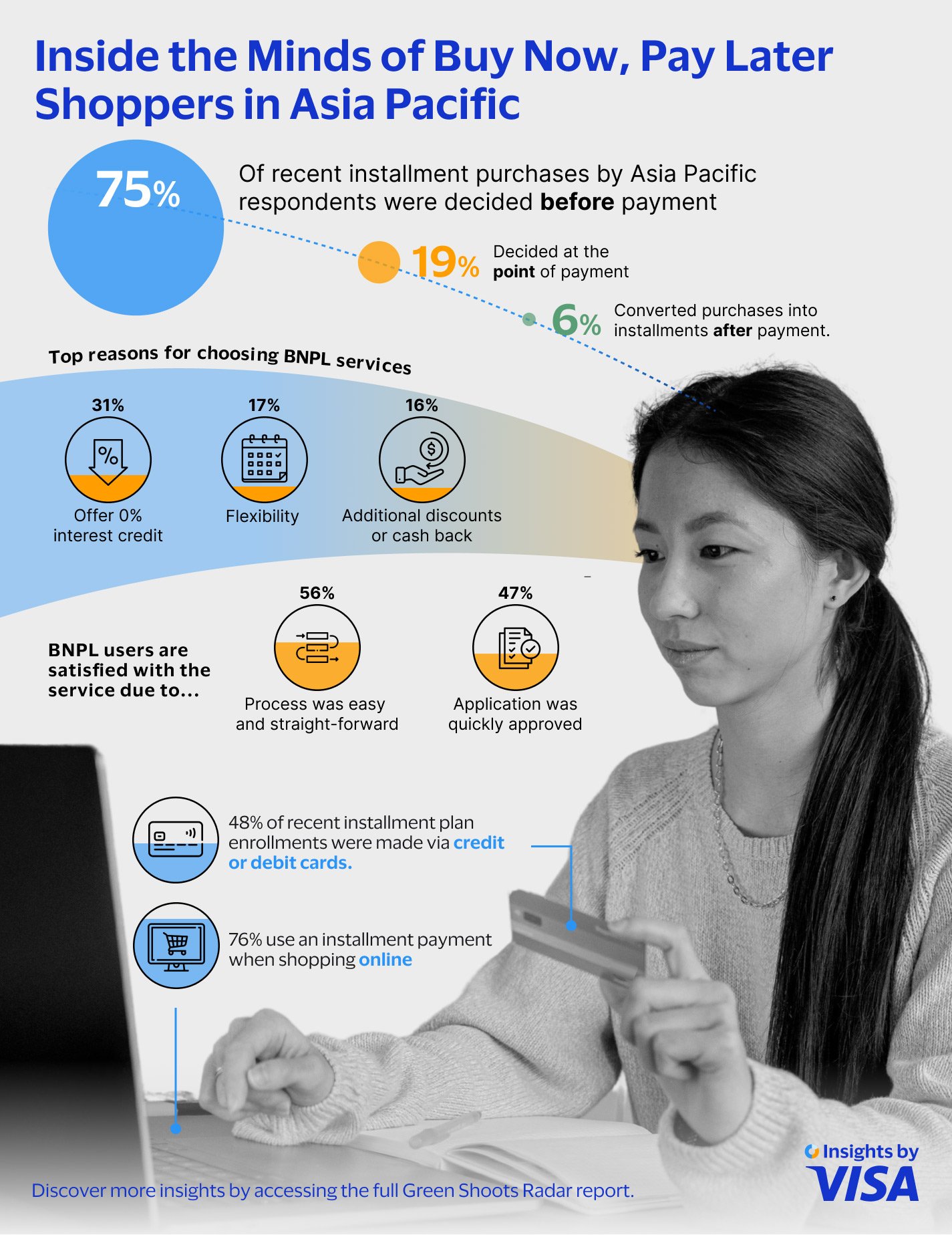

According to the Green Shoots Radar survey, in the last 12 months, more than three in four installment purchases by Asia Pacific respondents were decided before payment, while 19% were decided at the point of payment, and only 6% converted their purchases into installments after payment. This finding suggests that payment by installments is a planned decision, and that the greatest opportunity to influence this lies in the early stage of consumers’ buying journey.

Comparing BNPL platforms and credit cards

Visa’s Green Shoots Radar survey also found that Asia Pacific consumers enjoy the practicality, flexibility, and rewards offered by installment payments. The top three reasons why respondents in Asia Pacific chose BNPL services were that they offered 0% interest credit (31%), flexibility (17%), and additional discounts, or cash back (16%).

Speed and convenience are also key factors: two in three Asia Pacific consumers were satisfied with their installments because of the simple and straightforward application process, half of Asia Pacific respondents were drawn to the quick approval processes, and 39% appreciated the absence of hidden costs and surcharges.

Easier access to credit offered by BNPL platforms compared to other types of installment products is a key driver of their popularity. They tend to have “softer” credit requirements compared to income assessments that consumers undergo for credit card applications. It is not surprising that BNPL platforms or apps tend to appeal more to younger consumers who may not have access to a bank-issued credit card.¹

BNPL platforms also offer more variety in payment terms. Customers can choose to split the payments into a shorter time frame, such as six-monthly installments while credit cards typically offer longer payment periods of 12 months to 48 months, or four years. Unlike credit cards, which can be used for multiple purchases, a BNPL platform may only offer credit for a specific purchase. In some cases, local regulations cap allowable outstanding payments, with Singapore prohibiting BNPL users.²

Card installments are still king

Despite the growth of BNPL platforms, credit card and debit card installments are still the most prevalent in Asia Pacific. More than half of Asia Pacific respondents in the Green Shoots Radar survey are aware of installment options for credit cards, and almost half (48%) of their recent installment plan enrollments were made via credit or debit cards.

This figure is highest in Taiwan, Hong Kong, Japan, and South Korea, where over six in 10 installment transactions were made with credit cards, and they seemed to be popular with Gen X (50%) and Baby Boomer (60%) respondents.

¹ Visa, Green Shoots Radar Wave 13 Report, accessed March 2023

² Bank for International Settlements, https://www.bis.org/publ/qtrpdf/r_qt2312e.htm, accessed April 2024

³ Today, https://www.todayonline.com/singapore/code-conduct-protect-consumers-buy-now-pay-later-2024536, accessed April 2024