Three ways the ecosystem can enhance financial literacy in Asia Pacific

In Asia Pacific’s dynamic economic landscape, financial literacy is a cornerstone of success for small and medium-sized businesses (SMBs). Entrepreneurs with a firm grasp of financial principles are better positioned to make informed decisions regarding budgeting, capital allocation, and growth. This knowledge enables them to analyse cash flow, forecast earnings, and allocate resources wisely, setting them up for success.

Despite this, only one in three adults in Asia Pacific are deemed financially literate. This implies that a potentially large proportion of SMB owners can lack the know-how to navigate financial waters, make informed financial decisions, and importantly, discover sources of working capital for their business.¹ The consequences of insufficient financial literacy are particularly pronounced among young people, who often face barriers that prevent them from accessing essential financial resources, services, and education.

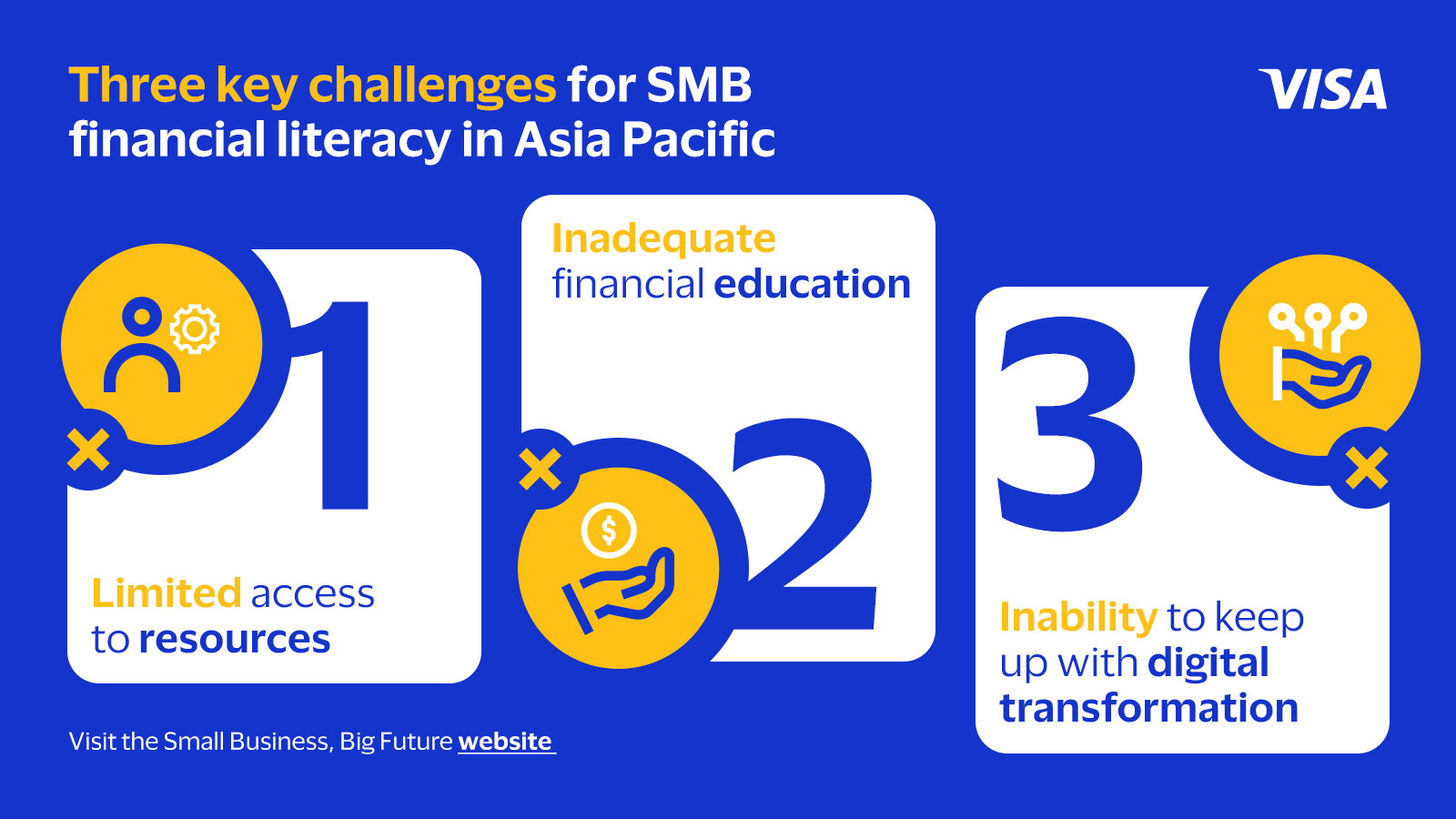

The challenges surrounding financial literacy can be broadly categorised onto three fronts: Limited access to resources; inadequate financial education; and being unable to keep up with digital transformation.

First, many SMB owners, in Asia Pacific simply cannot access resources for financial management. This can steam from a lack of financial services in countries with less developed infrastructure, or a scarcity of financial education or mentorship that prevents SMBs from discovering financial solutions even if they exist. The absence of these resources restricts their ability to earn, save, and invest money effectively for their business, placing them at a disadvantage.

Financial education is often inadequately taught within schools and educational institutions, resulting in many SMB owners entering the business landscape with at best a rudimentary understanding of finance. The lack of formal curricula on financial literacy means that some business owners can be at a handicap against bigger and more resourced peers, while young aspiring entrepreneurs can find it too daunting to start their own business.

The above challenges can often be exacerbated by the rapid digitalisation that Asia Pacific is experiencing. With fintech platforms and alternative lending solutions on the rise, those without a foundational understanding of finance may find themselves lost or worse still, misuse these solutions without properly accounting for costs and risks. According to a non-profit study, financial literacy is a significant predictor of engagement with digital financial services such as investments and loans.²

Three ways to enhance financial literacy in the region

Addressing these three critical issues is essential for enhancing financial literacy among SMBs and young entrepreneurs. By improving access to resources, bolstering educational support, and fostering digital competencies, stakeholders can help empower individuals to make informed financial decisions that lead to greater economic stability and growth.4.5

The collaboration between fintech companies and financial institutions is crucial for expanding financial inclusion among SMBs. By combining fintechs’ technological expertise with institutions’ established networks, these partnerships can maximise the reach of financial services. For example, Lufax, a Chinese fintech company, offers inclusive financial products designed to support SMBs and individuals. Partnering with over 550 financial institutions in China, Lufax employs an offline-to-online model that leverages a vast direct sales network to improve accessibility for underserved markets.

Partnerships across industries can also yield targeted solutions to solve specific challenges in different sectors. For instance, Visa’s partnership with the Grow Asia Business Council³ is aimed at addressing financial inclusion among smallholder farmers in countries like Cambodia, Indonesia, and Vietnam, who can lack access to digital tools and knowledge in sustainable farming practices that can benefit crop yields in the long run.⁴

In another partnership, Visa worked with The Asia Foundation, a non-profit organisation, to drive the Accelerate My Business programme. The programme offers budding entrepreneurs mentorship opportunities and essential business skills. It has already helped several SMB owners in the region, such as a female entrepreneur in Lombok, Indonesia, who turned knowledge learned from the programme into a growing snack business.⁵

In addition to support from the public and private sectors, technologies like AI-driven tools can also be harnessed to help SMBs access financial resources more efficiently. For example, Corpdaq, a startup founded in 2024 in Singapore, aims to simplify financial planning for SMBs through its AI-powered financial simulator.⁶ This platform features an AI Assistant that guides users with limited financial expertise through the simulation process, making complex financial concepts more accessible. By providing tailored insights and recommendations, Corpdaq enables business owners to make informed decisions regarding budgeting, forecasting, and strategic investments.

As the digital economy in the Asia Pacific rapidly evolves, SMBs without financial literacy will struggle to keep pace. To bridge this gap, SMBs must increasingly engage with the financial ecosystem, leveraging programmes and resources from governments, fintechs, and financial institutions. By embracing innovative solutions like AI and financial literacy initiatives, SMBs can enhance their financial management skills, improve decision-making, and drive sustainable growth in an increasingly competitive landscape.

¹ Visa, Enabling Small and Medium-Sized Businesses (SMBs) with Access to Funding and Financial Education, 2024.

² Tech for Good Institute, Digital Financial Services for Financial Inclusion in Southeast Asia, 2022.

³ Grow Asia, Grow Asia Welcomes Visa as Business Council Co-Chair, 2023.

⁴ Lufax Holding, FAQs, accessed September 2024.

⁵ Visa, The Asia Foundation, and AT&T, From Hard Times to Hope, 2022.

⁶ Y Combinator, Corpdaq: Stripe of Lending for Asia, accessed September 2024.