What do SMBs need to get on the digital payment highway?

What do SMBs need to get on the digital payment highway?

Today, small and medium-sized businesses (SMBs) in Asia Pacific must embrace digital payments or risk being left behind. Adopting digital payments is not just about keeping pace with the latest technology; it is also about seizing opportunities to reach more consumers and improve efficiency. Across the region, 98 per cent of SMBs surveyed in 2023 believe in going cashless, with 59 per cent aiming to do so by 2025.¹ Hence, those that do not digitalise fast enough could lose their competitive edge to those that do.

Practicality and security perceptions are digital roadblocks

However, not every SMB is in the same position on the digital payment highway. With Asia Pacific home to over 200 million SMBs, every SMB’s journey differs.² From rural enterprises like the mom-and-pop stores of Indonesia to urban microenterprises in markets like Japan, SMBs face distinct challenges unique to their economic environments.

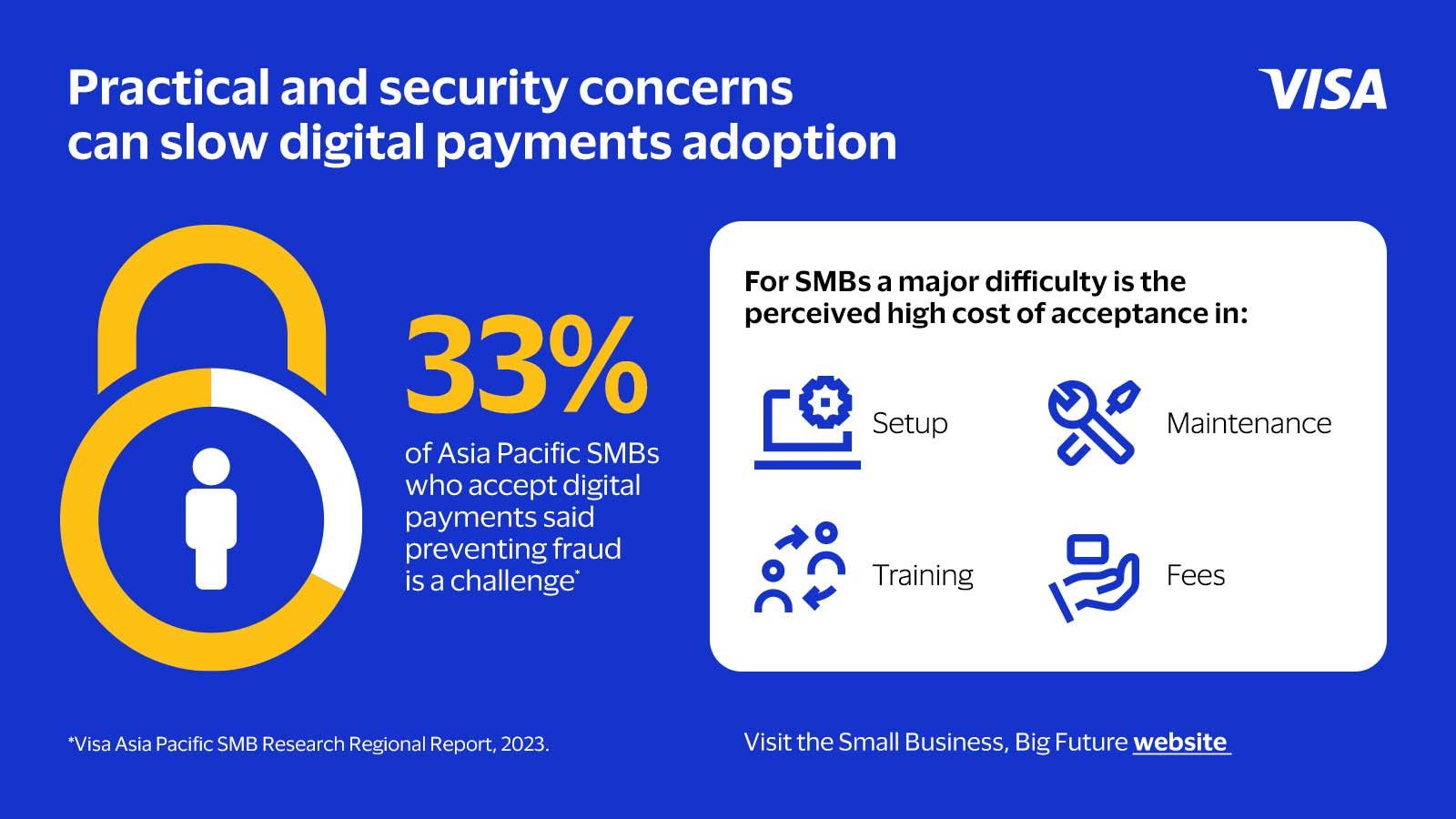

For many SMBs, a major difficulty is the perceived high cost of acceptance, especially as they strive to balance profitability with modernising payment systems. In 2023, for instance, 26 per cent of Asia Pacific SMBs that did not accept card payments felt that transaction fees were high.³ Other practical costs related to setup, maintenance, and training can further reinforce the perception that transitioning to digital payments is financially challenging for SMBs.

Financial and digital education also remain inaccessible to SMBs in regions with limited resources or infrastructure. Without a solid grasp of digital tools and skills, some SMBs may struggle with transitioning to digital payments, hindering growth and innovation in the sector.

In addition, security concerns are a significant issue for SMB owners, especially with the rise of sophisticated cyber threats. In 2023, 33 per cent of Asia Pacific SMBs that accepted cards saw preventing fraudulent activity as a challenge when setting up card payments.⁴ These impressions hinder implementation efforts and contribute to SMBs' hesitation in fully embracing digital payments.

Every SMB is different, and so must the solutions

Given the different SMB needs at various stages of digital payments adoption, it is clear there is no one-size-fits-all solution. Hence, fintechs and financial institutions must acknowledge this reality, understand specific SMB needs, and deliver tailored solutions.

A key area that financial organisations can focus on is lowering the barriers to adoption. This involves reducing the cost and time involved in setting up digital payments. Take for example Maya and PayMongo, two popular fintech companies in the Philippines. Together with Visa, they offer Rapid Seller Onboarding (RSO) solutions to local SMBs that help SMBs accept digital payments within a fraction of the time, usually several weeks, compared to conventional digital onboarding processes.⁵

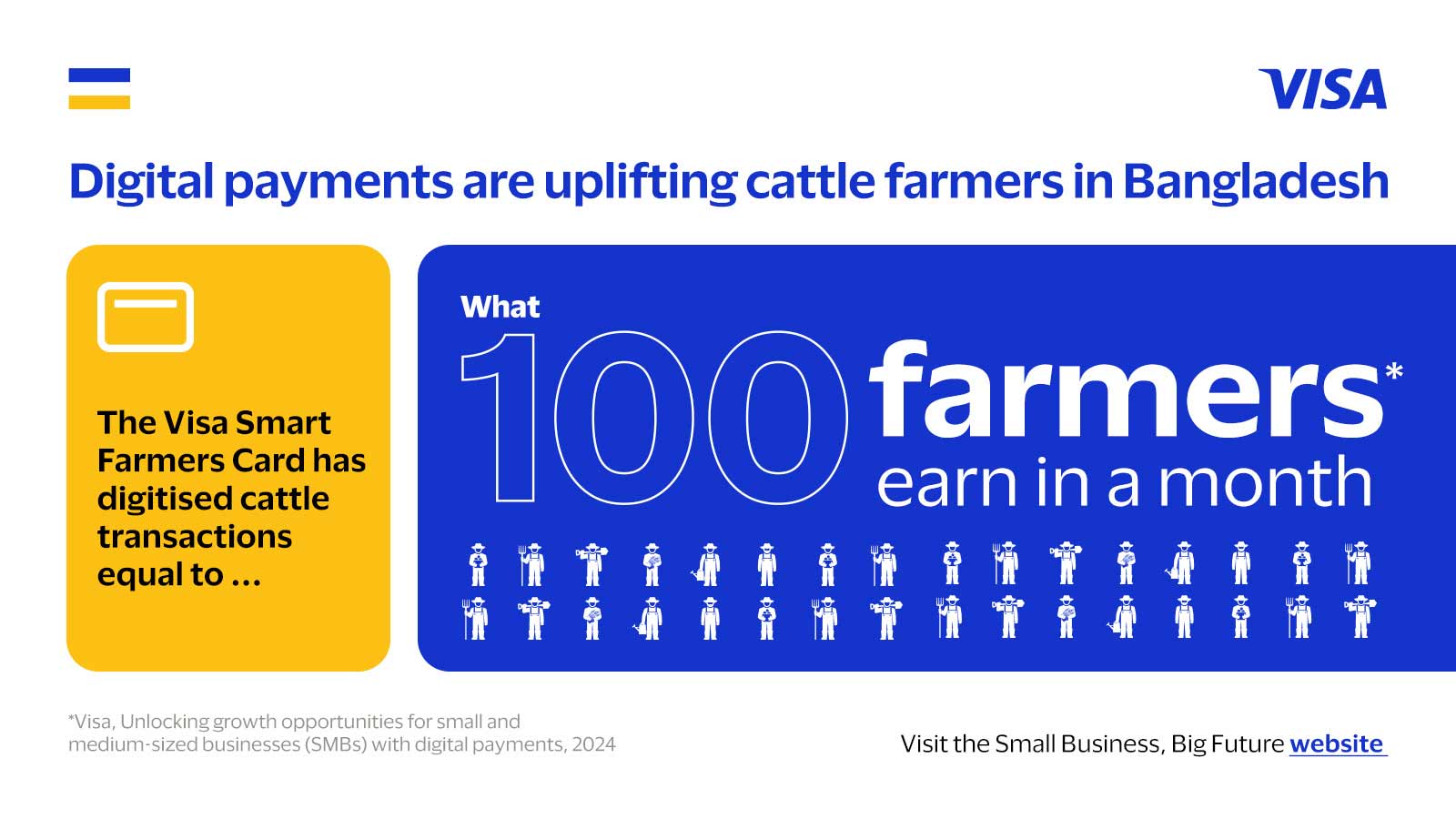

SMBs can address security concerns through innovative digital payment solutions offered by fintechs and financial institutions. In Bangladesh, for instance, cattle farmers benefited from the Smart Farmers Card, a collaboration between Visa and BRAC, the world’s largest non-governmental organisation. This card provides farmers with secure credit and debit functionalities, enabling them to store and withdraw funds securely and access working capital against credit limits. With the Smart Farmers Card, millions of Bangladeshi taka in cattle transactions were securely digitalised within months, equivalent to the monthly earnings of 100 local farmers.⁶

Finally, ongoing financial education for SMBs empowers owners with the knowledge needed to embrace digital solutions. A prime illustration is the Cambodian government's “Promoting Financial Literacy for Women and Women Entrepreneurs” programme. This two-year initiative provides training, forums, and workshops aimed at elevating digital and financial literacy among female SMB owners in rural areas.⁷ Additionally, initiatives like Visa’s Practical Business Skills uplift SMBs throughout their business journey, covering essential topics such as financial basics and accounting.

To thrive in the digital age, SMBs require tailored payment solutions that align with their business objectives. This demands the financial ecosystem to deliver seamless offerings that do not burden SMBs with unnecessary complexities or time constraints. With the right support, SMBs can flourish along the digital payment highway, from urban hubs to rural areas. The financial ecosystem must rise to this challenge, providing the necessary infrastructure and tools for SMBs to succeed in the digital realm.

¹ Visa Back to Business SBO Survey, 2023.

² Visa, Unlocking growth opportunities for small and medium-sized businesses (SMBs) with digital payments, 2024.

³ Visa Asia Pacific SMB Research Regional Report, 2023.

⁴ Visa Asia Pacific SMB Research Regional Report, 2023.

⁵ Visa, Unlocking growth opportunities for small and medium-sized businesses (SMBs) with digital payments, 2024.

⁶ Visa, Unlocking growth opportunities for small and medium-sized businesses (SMBs) with digital payments, 2024.

⁷ Visa, Financial literacy and women empowerment programs underscore Visa’s commitment to Cambodia, 2023.